Covered California Holds Rate Increases Down For Second Consecutive Year

Average Increase Is 4 Percent; Consumers Who Shop Can Lower Their Premium by an Average of 4.5 Percent

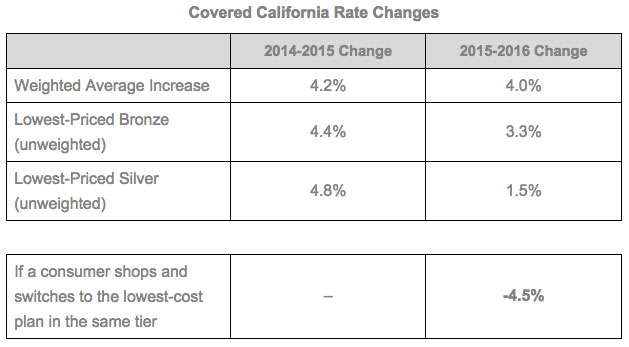

SACRAMENTO, Calif. — Covered California announced its rates for 2016 and unveiled which health insurance companies will be offering plans through the marketplace. The statewide weighted average increase will be 4 percent, which is lower than last year’s increase of 4.2 percent and represents a dramatic change from the trends that individuals faced in the years before the Patient Protection and Affordable Care Act.

This means the majority of Covered California consumers will either see a decrease in their health insurance premiums or an increase of less than 5 percent if they choose to keep their current plan. In addition, consumers can reduce their premiums by an average of 4.5 percent, and more than 10 percent in some regions, if they shop around and change to a lower-cost plan within the same metal tier.

“This is another year of good news for California’s consumers and further evidence that the Affordable Care Act is working,” said Covered California Executive Director Peter V. Lee. “Covered California is holding the line on rates and keeping coverage within reach of hundreds of thousands of consumers, while giving them more choices than ever before.”

California Health and Human Services Secretary and Covered California Board Chairwoman Diana S. Dooley said, “Covered California is using all the tools provided by the Affordable Care Act, including the expansion of Medi-Cal, to provide coverage and care to millions.”

Today’s announcement continues a downward trend of rate increases in California. Prior to the Affordable Care Act, annual double-digit rate increases were common in the state’s individual health insurance market. Covered California’s negotiated rates for 2014 were significantly lower than many experts predicted, and the 4.2 percent weighted average increase for 2015 was a fraction of previous historical trends. Also, since Covered California requires health insurance carriers to offer the same products at the same prices both inside and outside Covered California’s marketplace, all individuals seeking to buy health insurance benefit from these rates.

“Health care is local,” said Lee. “And as good as these average premium changes are across the state, it is important to look locally at each region. For example, in the two regions that encompass Los Angeles, the most populous regions in the state, the weighted average increase for consumers who stay in their current plan is only 1.8 percent. In addition, if they shop around, they could reduce their current costs by more than 11 percent by moving to a lower-cost plan in the same metal tier.”

The weighted average increase for Southern California consumers who stay in their current plan is also 1.8 percent, while for consumers in Northern California it is 7 percent. Consumers in Southern California can save an average of nearly 10 percent by moving to a lower-cost plan in the same metal tier, while consumers in Northern California would potentially be able to limit their rate increase to an average of 1 percent if they did the same.

Another indicator of the downward trend in premiums, which is used by some national comparisons of rate changes, is the change in the lowest-cost Bronze plan and the lowest-cost Silver plan. This is an important reference point because consumers have the ability to change carriers and plans.

Lee credited several things with helping Covered California hold the line on rate increases:

- Covered California’s successful enrollment of more than 1.3 million active consumers resulted in a good “risk mix” and gives Covered California the negotiating power of one of California’s biggest health insurance purchasers.

- Covered California’s 2013 decision to discontinue health plans that did not meet basic standards stabilized the market and helped create a healthier pool of enrollees.

- Covered California used recent data analysis in its negotiations with plans to prove that our mix of young and ethnically diverse enrollees are among the healthiest in the country; health plans responded by lowering their rates.

- In addition, the Reinsurance and Risk Adjustment programs that are part of the Affordable Care Act mean the premiums are lower in general and that health plans cannot benefit by seeking to enroll a healthier population. (For additional details on the factors that went into the rates, see the fact sheet “Covered California’s Story for 2016: Good Rates and How We Got There,” online at www.coveredca.com/pdfs/newsroom/7-27-15-Good Rates-fact sheet.pdf.)

“The sheer numbers and overall health of our enrollees allowed us to sit down with the health insurance companies and negotiate rates downward, which will save our consumers more than $200 million in premiums,” Lee said.

Lee noted that Covered California is an “active purchaser,” which allows it to choose which plans participate in the exchange and then negotiate the rates, networks and quality elements to get the best value for consumers. Covered California also created a standard benefit design, which establishes the services that plans must offer and creates a level playing field where health insurance companies must compete on price and quality.

“If you really want to see the potential of the Affordable Care Act, California is a good test case as a state that is using all the tools available to us,” Lee said.

Covered California also announced two new health insurance companies: Oscar Health Plan of California and UnitedHealthcare Benefits Plan of California will be joining selected regions of the California marketplace in 2016, bringing the total number of companies offering health plans through the exchange to 12.

UnitedHealthcare is the largest single health carrier in the United States, and it will be offering coverage in California in pricing regions 1, 9, 11, 12 and 13. Oscar is a new health insurance company that specializes in offering its members intuitive technology tools aimed at guiding them to better care. Oscar will offer plans in regions 16 and 18.

With the addition of the new carriers, and the expansion of its current carriers, Covered California is increasing choice and access to plans and providers. Californians in large metropolitan areas, where most of the state’s population lives, will continue to have from five to seven health insurance companies to choose from. In 2016, almost all consumers, 99.6 percent, will be able to choose from three or more carriers, and all will have at least two to choose from. This is an important improvement for consumers who live in areas that have historically had a limited choice of providers.

“We have more quality plans to choose from, which are serving more parts of the state,” said Covered California Director of Plan Management Anne Price. “We’re giving our consumers the choice of more doctors and more hospitals to ensure they can get the right care at the right time.”

In 2016, more than 90 percent of hospitals (“general acute centers” as designated by the California Office of Statewide Health Planning and Development) in California will be available through at least one health insurance company, and now about three-quarters (74 percent) will be available through three or more companies.

Additionally, several quality health care improvements were achieved as part of Covered California’s negotiating process. (For additional details on how health plans are improving how care is delivered, see the fact sheet “Covered California’s Story for 2016: Beyond the Rates — Promoting Quality Care,” online at www.coveredca.com/pdfs/newsroom/7-27-15-Beyond the Rates-fact sheet.pdf.)

The rates submitted by the selected companies are tentative and subject to a 60-day public comment period and independent reasonability review by the state’s regulators. All 12 carriers will be reviewed by the California Department of Managed Health Care, and one carrier will also be reviewed by the California Department of Insurance. For both Oscar and UnitedHealthcare, their offerings for the 2016 plan year are contingent on both successfully obtaining their California Knox-Keene license from the Department of Managed Health Care.

Below is the complete list of the companies selected for the 2016 exchange:

|

For more details on the plans in specific pricing regions, see the booklet “Health Insurance Companies and Plan Rates for 2016,” posted online at www.CoveredCA.com/pdfs/7-27-CoveredCA-2016PlanRates-prelim.pdf.

Consumers will be able to shop around and look at their options during the upcoming renewal and open-enrollment period to decide whether to stay with their current plan or find another option that better suits their financial needs. Also, in most areas of the state, the federal subsidies given to enrollees to help reduce their overall costs will either increase or remain close to current levels and help offset any rate increase.

Covered California’s 2016 Shop and Compare Tool will be available online beginning the week of Aug. 3 at

http://www.coveredca.com/shopandcompare/2016/. Consumers will be able to look at plans and products in their area and get a preliminary estimate of costs and premium assistance for 2016 coverage.

Visit www.coveredca.com/pdfs/newsroom/CoveredCA-7-27-rate-announcement-graphics.pdf for presentation materials about Covered California’s plans and rates for 2016.

About Covered California

Covered California is the state’s marketplace for the federal Patient Protection and Affordable Care Act. Covered California, in partnership with the California Department of Health Care Services, was charged with creating a new health insurance marketplace in which individuals and small businesses can get access to affordable health insurance plans. Covered California helps individuals determine whether they are eligible for premium assistance that is available on a sliding-scale basis to reduce insurance costs or whether they are eligible for low-cost or no-cost Medi-Cal. Consumers can then compare health insurance plans and choose the plan that works best for their health needs and budget. Small businesses can purchase competitively priced health insurance plans and offer their employees the ability to choose from an array of plans and may qualify for federal tax credits.

Covered California is an independent part of the state government whose job is to make the new market work for California’s consumers. It is overseen by a five-member board appointed by the Governor and the Legislature. For more information on Covered California, please visit www.CoveredCA.com.