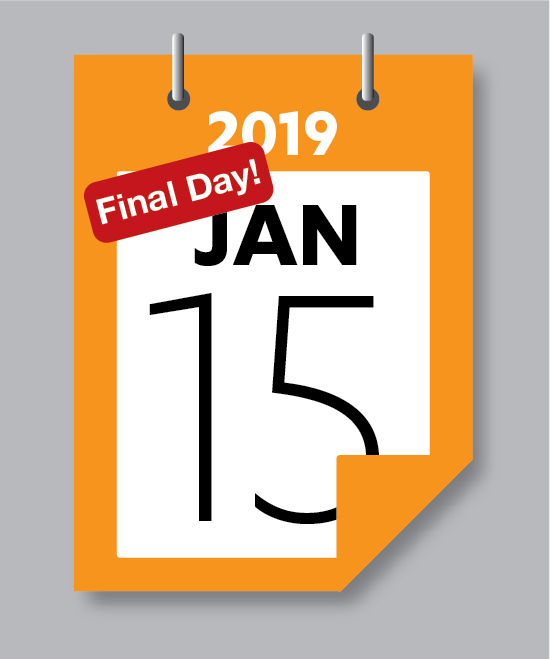

California’s Open Enrollment for Individuals Ends Jan. 15; Consumers Have One Week to Sign Up for Health Care Coverage

Tweet This

- Consumers have through Jan. 15 to sign up and select a plan through Covered California or directly with health plans for coverage that will begin on Feb. 1.

- The final week of open enrollment comes on the heels of Gov. Newsom’s announcing sweeping proposals, including a new requirement for having coverage and expanded subsidies.

- While open enrollment ended for much of the nation in December, California’s final deadline is about two weeks earlier than it was in previous years, when open enrollment ran through the end of the month.

- More than 238,000 consumers had selected a plan through Dec. 31.

SACRAMENTO, Calif. — Covered California is launching a final statewide enrollment tour to get the word out that the current open-enrollment period ends Jan. 15. For those interested in enrolling in a quality health insurance plan, next week’s deadline will mark the last opportunity for many to get coverage for all of 2019. This year’s deadline is shorter than in previous years, when open enrollment ran through the end of January.

“Covered California knows that many consumers are deadline driven and often wait until the final few days to sign up for health insurance,” said Covered California Executive Director Peter V. Lee. “We want to make sure they know that this year’s deadline is earlier than it has been in the past, and they must take action in the next week in order to get the peace of mind and protection they deserve in 2019.”

California is one of six marketplaces across the nation still enrolling consumers through open enrollment, accounting for a quarter of the United States population. California’s Jan. 15 deadline is due to a state law that established that open enrollment would run from Oct. 15 through Jan. 15 each year. Open enrollment is the one time of the year when consumers can sign up for coverage without needing to meet any conditions.

“Do not wait until the last minute, or let this deadline go past, without checking your options,” Lee said. “In only a few minutes at coveredca.com, you can see which plans are available in your area and whether you qualify for financial help to bring the price of coverage within reach.”

Covered California’s announcement comes one day after Gov. Gavin Newsom announced, as his first official act, that he will focus on making health care more affordable.

“We applaud Gov. Newsom for building on the strong foundation of the Affordable Care Act in his first official action,” Lee said. “At a time of ongoing uncertainty in Washington, the governor is not only embracing policies that will lower the cost of coverage for millions in the individual market, but he is also offering increased help to those who are struggling with rising costs.”

The governor proposes to make health care more affordable and restore the individual shared responsibility provision, which was repealed by the federal government in 2019, as part of his goal to continue toward universal coverage.

“Gov. Newsom’s proposals mark concrete and meaningful steps to lower health care costs for millions and increase enrollment,” Lee said. “We look forward to action from Sacramento in the weeks and months ahead, but today the action is happening in local communities across California where individuals can embrace this reminder from the governor of the importance of coverage and sign up through Jan. 15.”

The majority of uninsured Californians who are eligible for financial help either do not know or mistakenly think they do not qualify. Nearly nine out of 10 Covered California consumers receive financial help. The average Covered California enrollee pays about $5 per day for coverage, but many pay far less. One out of every three Covered California consumers who receive financial help can purchase a Silver plan — which provides the best overall value — for $50 or less per month. Nearly three out of five of these consumers can get a Silver plan for $100 or less per month.

Consumers can easily find out if they are eligible for financial help and see which plans are available in their area by entering their ZIP code, household income and the ages of those who need coverage into Covered California’s Shop and Compare Tool.

As of Dec. 31, more than 238,000 consumers had signed up and selected a plan during the current open-enrollment period, which remains in line with projections that there would be decline in enrollment due to recent federal policies and ongoing confusion sowed at the national level. In addition, Covered California previously announced that roughly 1.2 million existing consumers had renewed their coverage for 2019.

Those interested in learning more about their coverage options should go to www.CoveredCA.com, where they can get help to enroll. They can explore their options and find out if they qualify for financial help by using the Shop and Compare Tool. They can also get free and confidential enrollment assistance by visiting www.coveredca.com/find-help/ and searching among 700 storefronts statewide or 16,000 certified enrollers who can assist consumers in understanding their choices and enrolling, including individuals who can assist in other languages. In addition, consumers can reach the Covered California service center by calling (800) 300-1506.

About Covered California

Covered California is the state’s health insurance marketplace, where Californians can find affordable, high-quality insurance from top insurance companies. Covered California is the only place where individuals who qualify can get financial assistance on a sliding scale to reduce premium costs. Consumers can then compare health insurance plans and choose the plan that works best for their health needs and budget. Depending on their income, some consumers may qualify for the low-cost or no-cost Medi-Cal program.

Covered California is an independent part of the state government whose job is to make the health insurance marketplace work for California’s consumers. It is overseen by a five-member board appointed by the governor and the Legislature. For more information about Covered California, please visit www.CoveredCA.com.