Covered California Launches the National 2022 Open-Enrollment Period From the Golden State With HHS Secretary Xavier Becerra

- The open-enrollment period for Affordable Care Act marketplaces begins on Nov. 1, and millions of Americans are eligible for more financial help than ever before.

- Increased financial help builds on the Affordable Care Act to lower premiums throughout all of 2022, and potentially through 2025 with the proposed Build Back Better plan, helping millions of Americans get and stay covered.

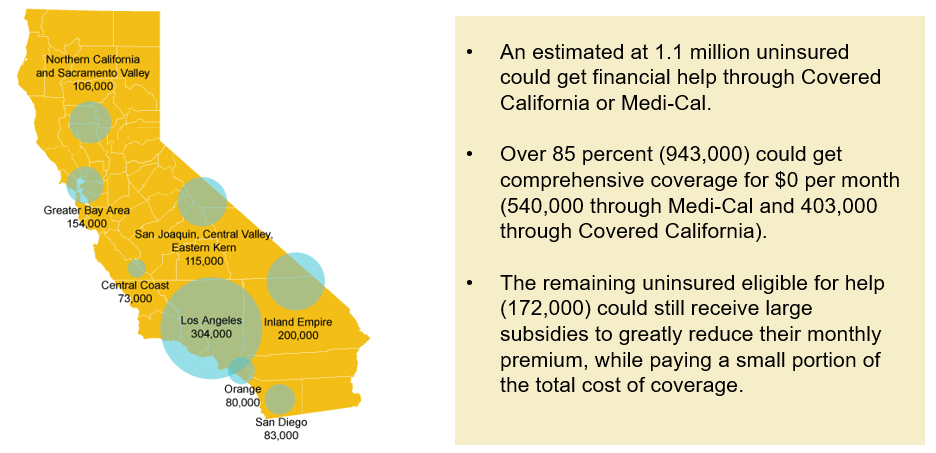

- While California has reduced the rate of the uninsured to historic lows, an estimated 1.1 million are still uninsured and eligible for financial help, with the vast majority able to get coverage at no cost through either Covered California or Medi-Cal.

- With new subsidies, hundreds of thousands of middle-income people — both uninsured and those who purchase coverage directly from a health insurance company — can now save thousands of dollars a year on their premiums if they sign up through Covered California.

- Covered California is also launching a new statewide ad campaign to encourage people to visit CoveredCA.com to check out their options and see how they can benefit from the new financial help now available.

SACRAMENTO, Calif. — Covered California welcomed Secretary Xavier Becerra of the U.S. Department of Health and Human Services to officially launch open enrollment across the nation for the 2022 coverage year. Open enrollment is a time when Americans can sign up for or renew their coverage through Affordable Care Act marketplaces. This year, they could benefit from more financial help than ever before.

“The Biden-Harris Administration is investing in the most robust open-enrollment campaign to date — with record-low prices, more choices and 30 more days to pick a plan than last season,” said Health and Human Services Secretary Xavier Becerra. “Health care should be a right and in reach for everyone. This open-enrollment season, we will get closer to achieving that goal.”

The open-enrollment period begins with a record-high 12.2 million people enrolled in the federal and state marketplaces, including 1.6 million in Covered California. The increased enrollment has been driven by the new and expanded financial help available through the American Rescue Plan, as part of the landmark federal response to the COVID-19 pandemic and the recession it sparked.

“Secretary Becerra and the Biden administration have shown that by building on the Affordable Care Act, we can go a long way toward achieving our goal of true universal coverage,” said Dr. Mark Ghaly, California Health and Human Services secretary and chair of the Covered California Board of Directors. “Californians need to see what their coverage options are and find out how affordable insurance can be at CoveredCA.com.”

A recent report found that California had reduced the rate of the uninsured to a record-low 6 percent of the population. For those who are still uninsured, the increased financial help is good news for the estimated 1.1 million Californians eligible for financial help. More than 85 percent of that group (about 940,000 people) could get comprehensive quality care with no monthly premium (see Figure 1: Over a Million of California’s Uninsured Could Get Quality Coverage for 2022 at a Very Low Cost).

“The Affordable Care Act is working both nationally and here in California, serving as a critical safety net for those who need coverage, and now is the time to sign up,” said Peter V. Lee, executive director of Covered California. “The amount of financial help available through 2022, and for many years to come if the Build Back Better plan is enacted into law, will cover the entire cost of many people’s monthly premiums.”

Figure 1: Over a Million of California’s Uninsured Could Get Quality Coverage for 2022 at a Very Low Cost**[1]**

Click here for a chart pack of the data presented in this release.

Californians See Big Savings

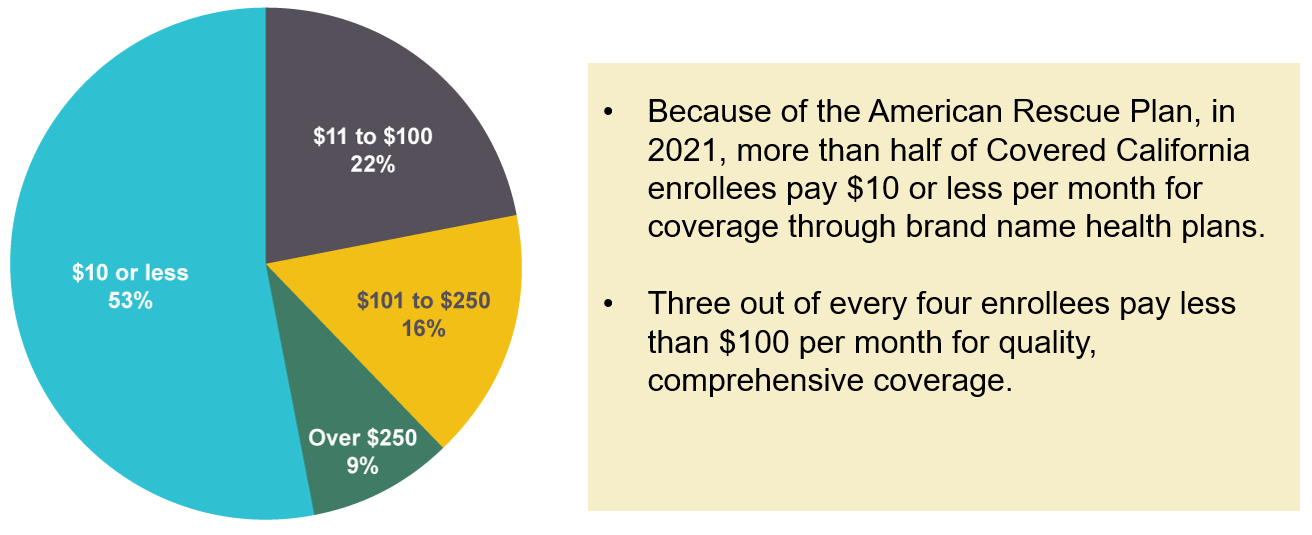

In California, more than 70 percent of consumers who get subsidies could choose health coverage for less than $10 per month, which is very similar to the national figure. In 2021, because many consumers chose to get richer benefits that better meet their needs, more than half of subsidized consumers are paying less than $10 per month and 75 percent paying less than $100 for their brand-name health plan (see Figure 2: Covered California’s Subsidized Enrollees Are Getting Brand-Name Coverage for Less in 2021).

Figure 2: Covered California’s Subsidized Enrollees Are Getting Brand-Name Coverage for Less in 2021

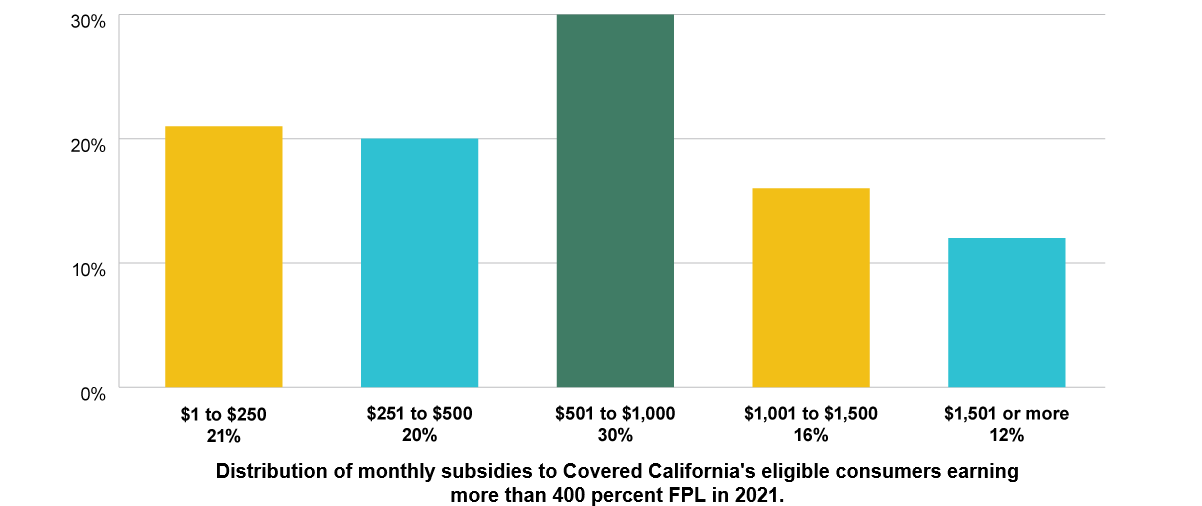

In addition, one of the big improvements of the American Rescue Plan is that is makes financial help available for middle-income consumers who were previously ineligible for federal assistance. (Though in 2020, many received the landmark California state subsidies that set the path for the American Rescue Plans’ expanded assistance.) Now, families earning more than $100,000 a year can be eligible for financial help. On average, the families who are receiving subsidies are saving nearly $800 a month on their premiums. (See Figure 3: New Financial Help Is Delivering Big Savings to Middle-Income Consumers.)

Figure 3: New Financial Help Is Delivering Big Savings to Middle-Income Consumers

The open-enrollment period is also a time to save for those who are currently insured directly through a health insurance company. An estimated 260,000 Californians have direct coverage — also known as “off-exchange” coverage. They can sign up through Covered California and potentially get the same plan they have off-exchange, or shop for other coverage that best fits their needs, and save hundreds of dollars per month.

“Californians who are paying for health insurance directly can switch to Covered California and get the same level of coverage — likely from the same company — and save thousands of dollars over the course of the year,” Lee said. “These are the last Americans not getting federal financial help to cover their insurance, since even those of us with employer-based coverage get an invisible leg up from the federal tax system to make our coverage more affordable.”

New Television Ad Campaign and Statewide Outreach Target California’s Diversity

For Covered California, open enrollment is also an opportunity to continue its work to address historic disparities in health care by ensuring that Californians of all races, ethnicities, income levels, genders and locales get access to health care coverage.

Covered California announced the launch of a new statewide ad campaign to promote open enrollment. The campaign, titled “This Way to Health Insurance,” will be aired in English, Spanish, Mandarin, Cantonese, Korean and Vietnamese. The campaign is directed by award-winning director Luis Peña and seeks to engage California’s diverse population.

The ad “Heart” features the story of a new father, whose love and concern for his children make him realize the importance of having health insurance. “Corazón” features the story of another father, who sees his daughter growing up and reaffirms the importance of taking care of her and himself.

Increased Competition and Consumer Choice

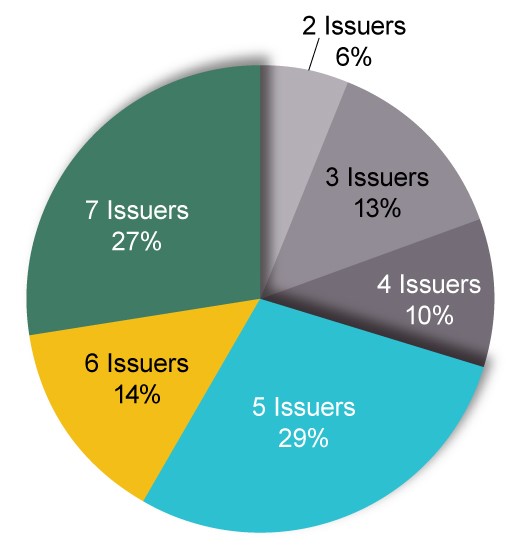

Californians will find they have more health insurance options to choose from this year. Starting in 2022, three of Covered California’s health insurance companies will expand their coverage areas, and a new company will join the marketplace. As a result, with 12 carriers providing coverage across the state in 2022, all Californians will have two or more choices, 94 percent will be able to choose from three carriers or more, 81 percent of Californians will have four or more choices, and 70 percent of people will have five or more carriers to choose from (see Figure 4: Robust Competition Means Covered California Consumers Are in the Driver’s Seat).

Figure 4: Robust Competition Means Covered California Consumers Are in the Driver’s Seat

“Consumers win in a competitive marketplace, and this year most Californians will have four or five insurance companies to choose from,” Lee said. “Covered California believes in putting consumers in the driver’s seat, so they can choose the option that works best for them.”

Consumers can discover their options by visiting CoveredCA.com and quickly and easily find out if they qualify for financial help and see the coverage options in their area. They just need to enter their household income, ZIP code, household size and the number of people who need coverage and their ages into the calculator on Covered California’s homepage.

In California, open enrollment runs through Jan. 31, 2022 and it is the one time of the year when eligible people cannot be turned away from coverage.

In addition to visiting CoveredCA.com, those interested in learning more about their coverage options can also:

- Get free and confidential assistance over the phone, in a variety of languages, from a certified enroller.

- Have a certified enroller call them and help them for free.

- Call Covered California at (800) 300-1506.

About Covered California

Covered California is the state’s health insurance marketplace, where Californians can find affordable, high-quality insurance from top insurance companies. Covered California is the only place where individuals who qualify can get financial assistance on a sliding scale to reduce premium costs. Consumers can then compare health insurance plans and choose the plan that works best for their health needs and budget. Depending on their income, some consumers may qualify for the low-cost or no-cost Medi-Cal program.

Covered California is an independent part of the state government whose job is to make the health insurance marketplace work for California’s consumers. It is overseen by a five-member board appointed by the governor and the Legislature. For more information about Covered California, please visit www.CoveredCA.com.

[1] Estimates derived from 2019 ACS data on overall uninsured under age 65, adjusted for California-specific estimates related to those ineligible for subsidies due to lacking lawful presence, having an available offer of affordable job-based coverage, or foregoing subsidies by enrolling off-exchange. While marketplace enrollment and Medicaid enrollment have both increased since the COVID-19 pandemic and the American Rescue Plan, as of the time of this analysis there remained uncertainty about the uninsured rate in 2021. (For a discussion, see https://aspe.hhs.gov/reports/tracking-health-insurance-coverage.)