Is it illegal to not have health insurance? Here’s what you need to know about the individual mandate and the tax penalty you could face for going without coverage.

Having health insurance isn’t just a good idea — if you live in California, it’s the law. In fact, 2020 marked the first year that Californians were required by state law to have health insurance. This law is referred to as the individual mandate because it means that all individuals in California are mandated to have health coverage.

Here’s what you need to know about the individual mandate.

Federal Law & the Affordable Care Act

The Patient Protection and Affordable Care Act (Obamacare) passed in 2010 with the mission of making quality health care more accessible and affordable nationwide. There were two key points of this act. First, people could no longer be denied or charged more for health insurance due to preexisting conditions. Second, a federal individual mandate was established, which meant that having health insurance that meets specific conditions – known as minimum essential coverage – was a requirement under law.

These two aspects worked hand in hand. By making sure everyone paid into the system — young and old, healthy and ill — the sickest members could receive care without premium costs going haywire for everyone. Since the individual mandate went into effect, those who chose to go uninsured faced a financial penalty at tax time.

That was the case until 2019 when the penalty was zeroed out via the Tax Cuts and Jobs Act. That meant that in 2019, many people were able to opt out of health insurance without paying a federal penalty. With no federal individual mandate in place, health insurance costs were on track to spiral higher and higher.

California’s Individual Mandate

In 2020, California became one of 5 states (plus Washington, D.C.) to implement its own individual mandate. The logic was the same as the federal individual mandate: The more people who have health insurance, the lower the cost of health insurance for everyone. This also decreases the number of uninsured treatments all residents wind up having to help pay for. When people who don’t have insurance go to the emergency room and can’t pay the bill, costs of treatments may go up for everyone — and taxpayers often have to pitch in to make up the difference. And like federal law under Obamacare, California defined minimum essential coverage the exact same way.

California’s Health Insurance Penalty

The individual mandate means that Californians must either have qualifying health insurance, or pay a penalty when filing their state tax return unless they qualify for an exemption. How much? For tax year 2023, the penalty will cost at least $900 per adult and $450 per dependent child under 18 in your household. A family of four who goes uninsured for the whole year will owe at least $2,700. Keep in mind, these penalties may vary from year to year.

More Financial Help for Californians

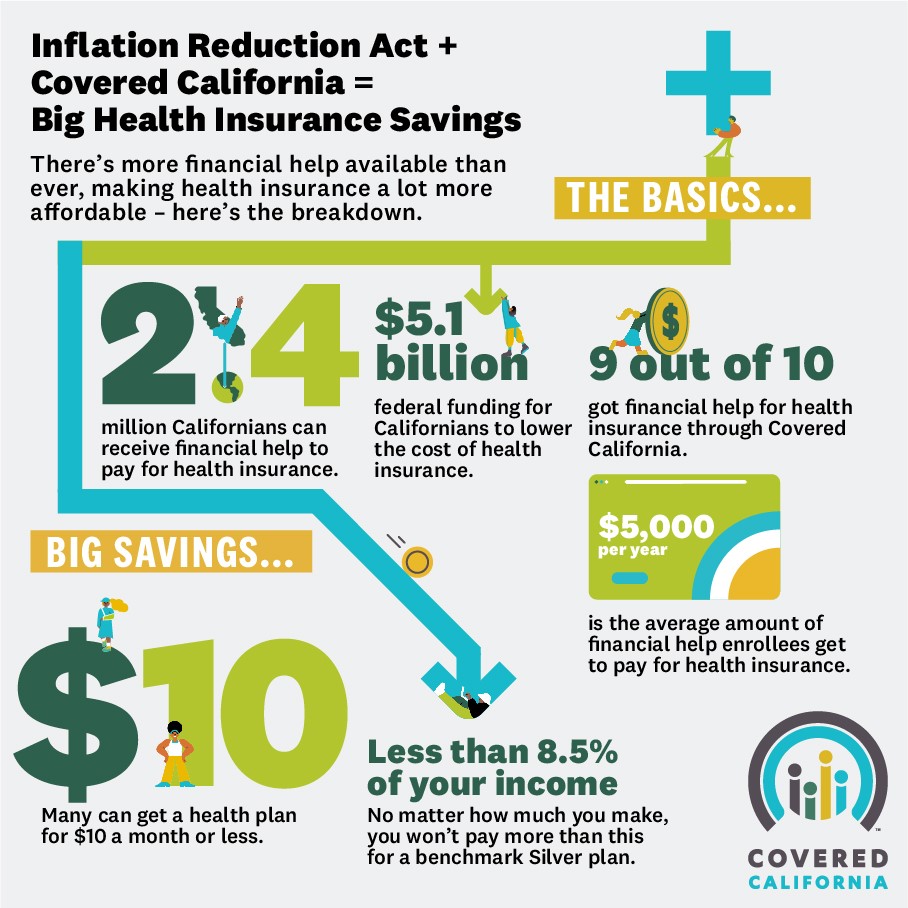

In 2021, in response to the COVID-19 pandemic, the American Rescue Plan provided $3 billion in new and expanded financial help to Californians to help pay for health insurance, making it more affordable than ever before. Thanks to the Inflation Reduction Act, this financial help has been extended through 2025 with enrollees saving an average of $5,000 a year on coverage.

Starting in 2023, penalties collected under the state’s individual mandate will be used towards making coverage even more affordable. This financial help will not only eliminate deductibles for many Californians but also decrease their costs on prescriptions, emergency care, and doctors visits!

No matter how much you make, you won’t pay more than 8.5 percent of your household income for a benchmark Silver plan. In fact, 9 out of 10 enrollees receive financial help and many pay $10 or less per month.

There are many reasons to have health insurance. The individual mandate is just one of them. Check out our interactive calculator to see just how much financial help you can get. Our shop and compare tool will show you what health plans options are available to you.