You Don’t Qualify for Medi-Cal Anymore. Now What?

Everything you need to know about finding a new health insurance plan and securing the financial help to pay for it.

Finding out your Medi-Cal coverage is discontinued might leave you with some pressing questions about what to do next. Most importantly: What am I supposed to do about health insurance now? Fortunately, there’s good news. Covered California makes it easy to find a new health plan that works for you and your budget. If you’ve recently lost your Medi-Cal eligibility, you don’t have to go without insurance. We’re here to help you get access to financial help and stay covered with quality, brand-name health plans tailored to your needs.

Keep reading to learn about your options and the simple steps you can take to ensure you remain insured.

Medi-Cal Eligibility and the COVID Public Health Emergency

When COVID-19 prompted a Public Health Emergency, Medi-Cal stopped making regular eligibility checks, and members could keep their coverage without renewing eligibility by providing up-to-date information. Now, the Medi-Cal renewal process has resumed, which means your Medi-Cal health coverage may change. If your life circumstances have changed since your last Medi-Cal eligibility check – such as your income, employment, or family size – read on to learn more about how to stay covered.

How Can Covered California Help?

Covered California is a free, state-run service that helps Californians get and pay for quality, brand-name health insurance. We also help you get financial help to make health coverage more affordable. In fact, 4 out of 5 enrollees receive financial help to pay for their coverage. If you’re no longer eligible for Medi-Cal, Covered California and Medi-Cal work together to ensure you can transition seamlessly and stay covered.

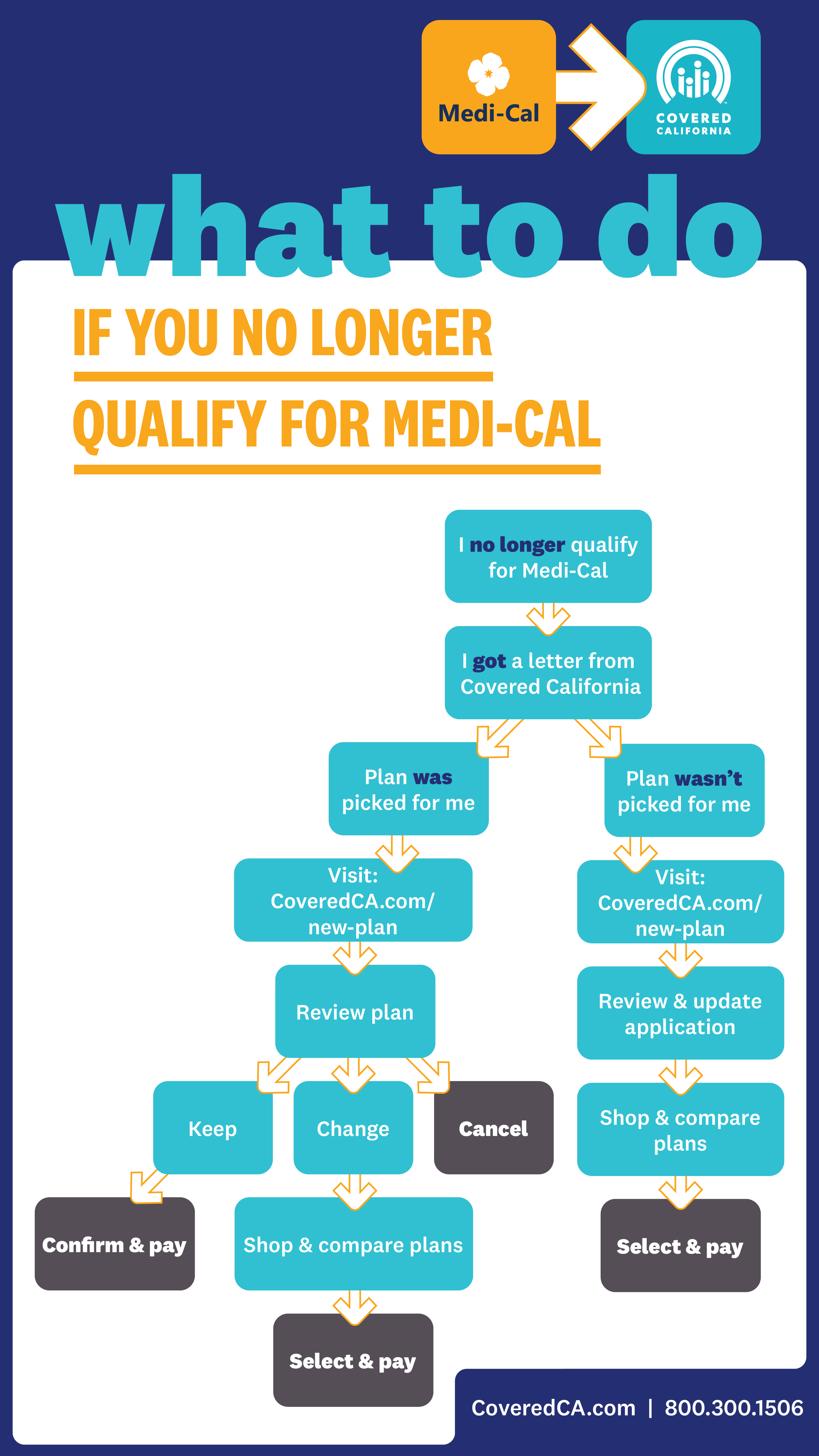

What happens next depends on whether or not a health plan was picked for you. Thanks to a 2019 state law, if your household income qualifies you for financial help, a plan will be picked for you by Covered California. If you don’t qualify for financial help (or if your income can’t be verified), you can still find a plan through Covered California – there may just be a few extra steps.

In either case, Covered California will mail you a notice (the Covered CA Eligibility Determination Notice) outlining your eligibility for coverage and financial help based on the information you provided to Medi-Cal. This notice will include important information such as your case ID number and, in some cases, an access code. You'll need this information to create a new account with Covered California, or you can simply log in to your existing account with your username and password. The notice will also explain the steps you need to take to stay covered.

Below is an overview of what you’ll need to do in both scenarios.

Yes, a Health Plan Was Picked for Me

Covered California picked a health plan for you to simplify the enrollment process and ensure you stay covered. You were matched with the lowest-cost Silver plan available to maximize the financial help you qualify for. The cost of your new monthly payment (premium) is based on your annual income and the financial help (tax credits) you qualify for. You can use Covered California’s quick quote tool to estimate your costs. Additionally, the notice you received will include important details such as the name of your health plan, your monthly premium, and the financial help you qualify for.

Either way, you’ll need to confirm or change your plan to stay covered. If you don’t, your plan will be canceled.

How to Keep, Change, or Cancel Your Plan

Keep: To keep the lowest-cost Silver plan, you must pay your first premium by the end of the first month of coverage. If your premium is $0, you still need to confirm your plan through Covered California.

If affordable coverage has been offered to you through your employer, or another program such as Medicare, you may not qualify for financial help through Covered California.

Change: You have 90 days from the last day of your Medi-Cal coverage to select a different plan. This is called your special enrollment window.

Cancel: You can also cancel your plan through Covered California. Your plan will be automatically canceled if you don’t confirm your plan and pay the premium.

No, a Health Plan Was Not Picked for Me

It’s possible you don’t qualify for financial assistance or Medi-Cal wasn’t able to confirm some important information like your address and income. No matter the reason, you need to take immediate action in order to prevent a coverage gap.

How to Get Covered

Correct an error: Review your information and report any changes. If you think your Medi-Cal coverage ending was a mistake, contact Medi-Cal directly through the Medi-Cal Member Helpline at 800.541.5555.

Get covered: Browse a variety of quality brand-name health insurance plans and get financial help to pay for the one that best fits your needs. Use Covered California’s calculator to quickly see how much financial help you qualify for. Rest assured, you won’t pay more than 8.5 percent of your income for a health insurance plan.

You have 90 days from the last day of your Medi-Cal coverage to sign up for a new health plan. If you miss this special enrollment window, you may have to wait until the next open enrollment period to sign up (unless you experience a major life change), and could face a penalty.

Understanding Medi-Cal Coverage and Employment

Changes to your employment status may impact your income, but having a job does not automatically affect your Medi-Cal eligibility. Many employed individuals continue to qualify for Medi-Cal. Eligibility is determined by multiple factors, including income and household size. Learn more about what determines your Medi-Cal eligibility here.

Need Help?

There are plenty of resources to help you understand your health insurance options. You can understand the difference between your “copayment” and your “cost-sharing” thanks to a glossary of terms. Plus, there’s a wealth of information online about how to use your plan, pay your premium, and more. Covered California is dedicated to helping you remain insured without a gap in coverage. We’re here for you over the phone, in-person, and online.

Related Topics

Ready to explore health plans?

We’re here to help you get the health insurance you need, regardless of your income or health history.