No Longer Qualify for Medi-Cal? Here’s How to Stay Covered

What you need to know about finding a new health insurance plan and the financial help to pay for it.

Finding out your Medi-Cal coverage is ending might leave you with some pressing questions. Most importantly: What am I supposed to do about health insurance now? The good news is that it’s never been easier to find a new health plan that works for you and your budget. If you have recently lost your Medi-Cal eligibility, you can stay covered — and get access to financial help — with Covered California. Read on to learn more.

Medi-Cal Eligibility and The COVID Public Health Emergency

When COVID-19 prompted a Public Health Emergency, Medi-Cal stopped making regular eligibility checks, and you could keep your coverage without providing up-to-date information. Now that the country is recovering, the Medi-Cal renewal process has resumed, and an estimated two million Californians may lose their health insurance plan. If your circumstances have changed in the last three years – such as your income, employment, or family size – you may be one of those Californians.

How Can Covered California Help?

We're a free service from the state that helps Californians get and pay for quality, brand-name health insurance. In many cases, this coverage comes at no cost to you, just like Medi-Cal. In fact, if you’re no longer eligible, Medi-Cal and Covered California have teamed up to help keep you covered.

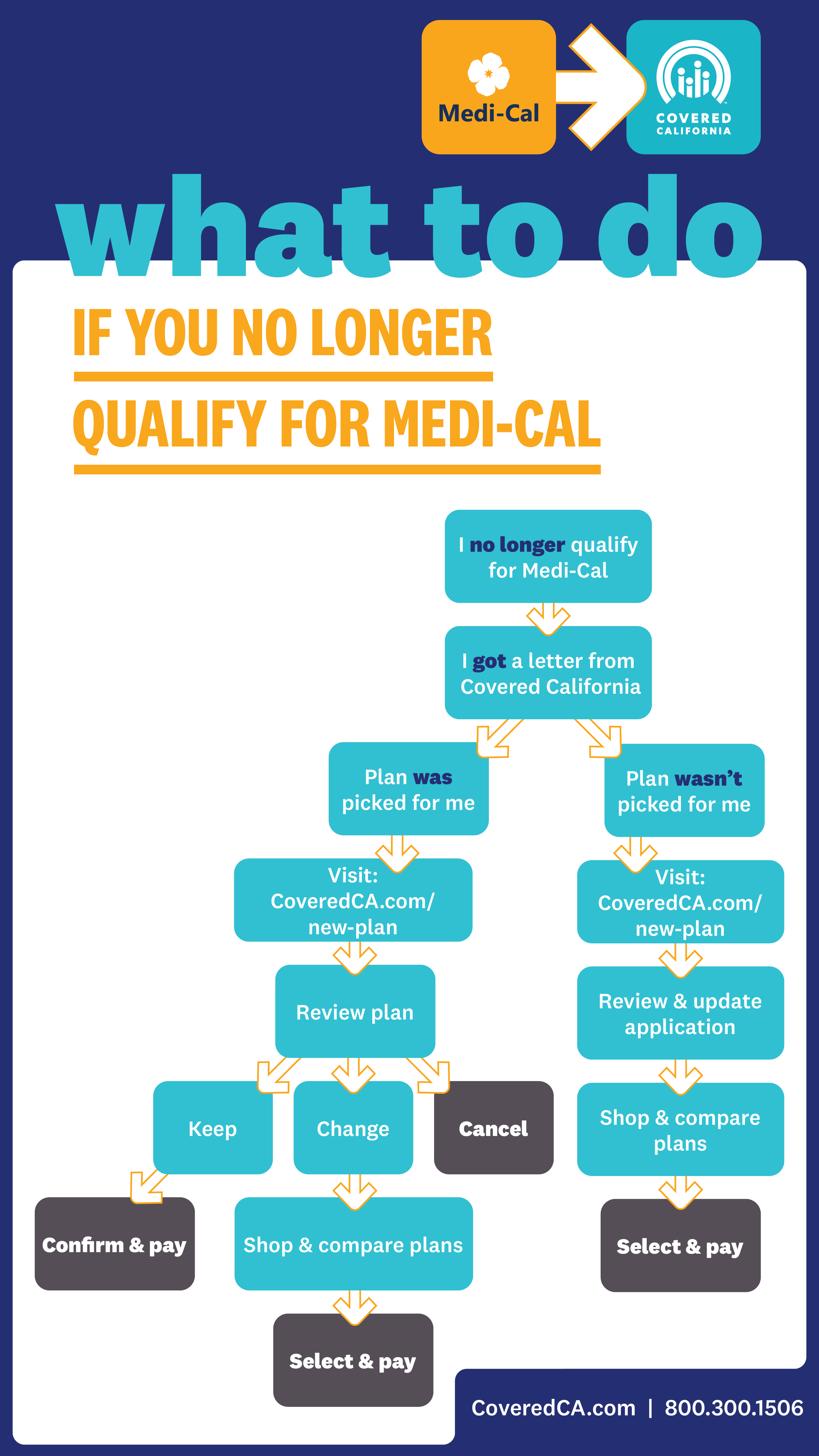

(Accessible Version of What to do if you no longer qualify for Medi-Cal)

Your next steps to staying covered depend on whether or not a health plan was picked for you. Thanks to a 2019 state law, if your household income qualifies you for financial help, a plan will be picked for you by Covered California. If you don’t qualify for financial help (or if your income can’t be verified), you can still find a plan through Covered California.

Either way, Covered California will mail you a notice about your eligibility for coverage and financial help based on the information you provided to Medi-Cal. The letter includes other important information, such as your case ID number and may also include an access code. You'll need this information to create a new account with Covered California. If you already have an account, simply login with your username and password. The letter also outlines the steps you need to take to stay covered. Here’s an overview of what you’ll need to do in both scenarios…

#1 Yes, a Health Plan Was Picked for Me

What happens…

A plan was picked for you to make the enrollment process easier and to also help keep you covered. You were matched with the lowest-cost Silver plan available to maximize just how much financial help you could get. The cost of your new monthly payment (premium) depends on your income. It might be as low as $0 per month, thanks to financial help (tax credits). You can get a quick quote here. Either way, you’ll need to confirm or change your plan to stay covered. If you don’t, your plan will be canceled.

What you need to do to keep, change or cancel your plan…

● Keep: To keep the lowest-cost Silver plan, you must pay your first premium by the end of the first month of coverage. If your premium is $0, you still need to confirm your plan through Covered California.

If affordable coverage has been offered to you through your employer, or another program such as Medicare, you may not qualify for financial help through Covered California.

● Change: You have 90 days from the last day of your Medi-Cal coverage to select a different plan. This is called your special enrollment window.

● Cancel: You can also cancel your plan through Covered California. Your plan will be automatically canceled if you don’t confirm your plan and pay the premium.

#2 No, a Health Plan Was Not Picked for Me

What happens…

It’s possible you don’t qualify for financial assistance or Medi-Cal wasn’t able to confirm some important information like your address and income. No matter the reason, you need to take immediate action in order to prevent a coverage gap.

What you need to do to get covered …

● Correct an error: Review your information and report any changes. If you think your Medi-Cal termination was a mistake, contact Medi-Cal directly through the Medi-Cal Member Helpline at 800.541.5555.

● Get covered: Browse a variety of brand-name health insurance plans and get financial help to pay for the one that best fits your needs. Use the website’s calculator to quickly see how much financial help you qualify for—many people pay as little as $0 per month. Rest assured, you won’t pay more than 8.5 percent of your income for a health insurance plan.

You have 90 days from the last day of your Medi-Cal coverage to sign up for a new health plan. If you miss this special enrollment window, you may have to wait until the next open enrollment period to sign up (unless you experience a qualifying life event), and could face a penalty.

Where Can I Go if I Need Some Help?

There are plenty of resources to help you understand your health insurance options. You can understand the difference between your “copayment” and your “cost-sharing” thanks to a glossary of terms. Plus, there’s a wealth of information online about how to use your plan, pay your premium and more. Covered California is dedicated to helping you remain insured without a gap in coverage. We’re here for you over the phone, in-person and online.

Related Topics

Ready to explore health plans?

We’re here to help you get the health insurance you need, regardless of your income or health history.